Basis Period Reform

Dear Nomi Partners,

We are pleased to introduce a significant change in UK tax reporting: the Basis Period Reform. This HMRC initiative aims to simplify tax processes for unincorporated businesses, including sole traders and partnerships. The reform alters how these entities calculate their taxable profits, moving from the traditional ‘basis period’ to a ‘tax year basis’. This shift aligns profit reporting more closely with the actual tax year, potentially reducing errors and complexity in tax returns. While this change may require some adjustment, it’s designed to create a more straightforward, efficient system for businesses and HMRC alike. Understanding this reform is crucial for affected businesses to ensure compliance and optimize their tax planning strategies.

What is Basis Period Reform?

The HMRC is introducing changes to how sole traders and partnerships calculate their taxable profits, known as the Basis Period Reform. This significant shift moves from the current system, where businesses use their accounting period to determine profits, to a new ‘tax year basis’. Starting from the 2024/25 tax year, unincorporated businesses will report profits earned within the actual tax year (April 6 to April 5).

This reform primarily affects businesses with accounting period end dates between March 31 and April 5, as well as new unincorporated businesses starting from April 6, 2024. The goal is to simplify tax reporting and create a more uniform system across all businesses.

While this change may require some adjustment, it’s designed to reduce complexity and potential errors in tax returns. Understanding these reforms is crucial for affected businesses to ensure compliance and effectively manage their tax obligations. This overview aims to clarify the key aspects of the Basis Period Reform and address common questions.

Meaning of ‘Basis Period’

The ‘basis period’ refers to the time used to calculate profits and income tax for a business. Traditionally, this period often aligned with a company’s accounting year, which could differ from the standard tax year. For example, a business might have an accounting year from 1 January to 31 December, while the UK tax year runs from 6 April to 5 April. The basis period reform aims to standardize this system. From the 2024/25 tax year onwards, all unincorporated businesses will use the UK tax year (6 April to 5 April) as their basis period for income tax assessment.

This change simplifies tax calculations and reporting, ensuring that all businesses are assessed on the same timeframe. It eliminates the complexity of aligning different accounting periods with the tax year, potentially reducing errors and making the process more straightforward for both businesses and HMRC.

Distinguishing ‘Accounting Period’ from ‘Basis Period’

The terms “Accounting Period” and “Basis Period” are related to financial reporting and taxation, but they refer to different concepts:

Accounting Period

Definition: An accounting period is the period covered by a set of financial statements. It is the period for which a company prepares its accounts and reports its financial performance and position.

Duration: Typically, an accounting period is one year, but it can also be quarterly, monthly, or semi-annually, depending on the business’s reporting requirements.

Purpose: The main purpose is to provide a framework for recording and reporting a business’s financial transactions and performance over a specific period.

Examples: Calendar year (January 1 to December 31), Fiscal year (e.g., April 1 to March 31).

Basis Period

Definition: A basis period is the time frame for which income is assessed for tax purposes. It is the period that a tax authority uses to determine the taxable income of a business.

Alignment with Accounting Period: For simplicity, the basis period often aligns with the accounting period, but this is not always the case. The basis period can differ depending on tax regulations and the specific circumstances of the business.

Purpose: The main purpose is to establish the timeframe in which income and expenses are evaluated for tax calculations.

Examples: If a business prepares its accounts for the year ending on March 31, 2023, the basis period for the tax year 2023/2024 would typically be the same.

Key Differences

Objective: The accounting period is primarily for financial reporting, while the basis period is for tax assessment.

Regulation: Accounting periods are determined by the business’s internal policies and accounting standards, whereas basis periods are defined by tax laws and regulations.

Flexibility: Businesses have more flexibility in choosing their accounting period. However, the basis period must comply with tax authorities’ requirements.

In summary, while both periods are essential for financial management and reporting, they serve different purposes and are governed by different rules and regulations.

Implications of Basis Period Reform

The Basis period reform aligns the basis period with the tax year, changing the way profits are allocated and taxed.

- Transition Year: The tax year 2023/24 will be a transition year where profits for the period from the end of the last accounting period to April 5, 2024, will be taxed.

- Overlap Relief: Businesses will be allowed to use “overlap relief” to mitigate double taxation during the transition, but this will require careful calculation and reporting.

Basis period reform can simplify tax compliance and financial management for businesses by aligning tax periods with accounting periods. However, it also presents transitional challenges, including administrative adjustments and potential cash flow impacts. Effective planning, communication, and support from tax authorities are essential to ensure a smooth transition and realize the benefits of such reform.

Businesses Affected by the Reforms

The change will affect unincorporated businesses, including self-employed traders, partners in trading partnerships, as well as other unincorporated entities with trading income. It may also impact businesses benefiting from government tax schemes like research and development (R&D) tax credits.

You may also refer to HMRC Guidance for any detailed help.

Up until the Tax year 2022-2023, every unincorporated business operates within its Accounting Period. According to HMRC, the Tax period spans from 6th April to 5th April the following year. During this period, starting from every 6th of April, we evaluate income and apply taxes accordingly. This established practice has been consistently followed to date.

However, the Sole Traders and Partners usually don’t follow the same tax year. They have accounting periods, let’s say August 2021 to July 2022 which is different to Tax Year. In this case, the Income and Expenses related to the Accounting Period August 2021-July 2022 are reported directly into the Tax Return period of 2022-23. We do not apportion the Income and expenses from August 2021 to April 2022 and from April to July. From the 2024/25 tax year, HMRC’s basis period reform means all unincorporated businesses will use the UK tax year of 6 April to 5 April as their basis period for income tax assessment.

Before we proceed further, we have to be clear with the below key terms:

- Overlap Relief

- Accounting Profits

- Transition Profits

- Transition Year

- Accounting Period

- Transition Period

- Basis Period

- Transition Period Spread

- Overlap Profits: Overlap profits occur when someone who is registered as self-employed chooses to report their income and expenditure in the self-employment section of their tax return for an accounting period that is not the same as the tax year. These overlapping profits will normally arise in their first 3 tax returns. To avoid double taxation, HMRC allows businesses to claim overlap relief. Overlap relief applies to profits that have been taxed more than once due to overlapping basis periods. This relief can be deducted from the taxable profits in the transition year.

If a sole trader chooses to draw up their income and expenditure for the accounting period that matches the tax year, then basis periods and overlap profits won’t arise. - Accounting Profits: Accounting profit, also known as net income or net profit, is the difference between a business’s total revenue and its total explicit costs over a specific period. Explicit costs include all direct costs associated with running the business, such as wages, rent, materials, and other operational expenses. These are related to a particular accounting period i.e. August 2022 to July 2023.

- Transition Profits: “Transition profits” in the context of HMRC (HM Revenue and Customs) refer to profits that are adjusted or re-evaluated during the transition from one accounting method or period to another. This often arises in the context of changes in tax rules, accounting standards, or business practices that necessitate a re-evaluation of previously reported profits.

- One significant context where transition profits are relevant is the alignment of accounting periods for tax purposes, especially in light of changes to the basis period rules for unincorporated businesses. As of the latest changes, HMRC has implemented new rules to align the accounting periods of businesses more closely with the tax year, leading to the concept of “transition profits.”

- Transition Year: The year in which the transition to the new rules takes place is known as the “transition year.” During this year, businesses might have to report profits for a period longer than 12 months or shorter as well. So, 2023-2024 is termed a Transition year and our transition profit after Overlap Relief will be spread over 5 years, starting with the tax year 2023 to 2024 and ending with the tax year 2027 to 2028.

- Accounting Period: The accounting period for self-employed individuals under HMRC (HM Revenue and Customs) refers to the time frame for which a self-employed person prepares their accounts and reports their profits or losses. This period is essential for determining the income that needs to be reported for tax purposes.

- Transition Period: The “transition period” as per HMRC, particularly in the context of the basis period reform for unincorporated businesses, refers to the time during which businesses adjust their accounting periods to align with the new tax year basis. This transition is part of HMRC’s efforts to simplify the tax system by ensuring that business profits are reported in line with the tax year (April 6 to April 5).

- Basis Period: The basis period as per HMRC (HM Revenue and Customs) refers to the time frame for which self-employed individuals and partnerships calculate their taxable profits. It determines the period of income that should be reported for a specific tax year. To keep it simple, we can understand in this way that the Accounting Period + Transition Period is the basis period.

- Transition Period Spread: The transition period spread refers to the option provided by HMRC for businesses to spread the taxable profits arising during the transition year over a specified period, typically up to five years. This helps businesses manage their tax liabilities more effectively during the shift to the new basis period rules.

Key Points about Transition Period Spread

- Purpose: To mitigate the financial impact of reporting a potentially higher amount of taxable profits in a single year due to the extended accounting period during the transition.

- Eligibility: Available to unincorporated businesses, including sole traders and partnerships, that need to align their accounting period with the tax year (April 6 to April 5).

- Transition Year: The transition year is typically the tax year 2023/24, during which businesses must adjust their accounting periods to align with the tax year.

- Extended Accounting Period: During the transition year, businesses may need to account for a period longer than 12 months. This could result in higher taxable profits for that year.

- Overlap Relief: Businesses can claim overlap relief to deduct any profits that have been taxed more than once due to overlapping accounting periods. After applying overlap relief, the remaining transition profits can be spread over several years.

Explanation with example

Let’s take an example and see how it fits into Nomi.

Test Case

1 Overlap Profits- £15000

- Accounting Profits- £55000 Aug 2022 to July 2023

- Transition Profits- £40000 Aug 2023 to 5 April 2024

- Total Taxable Profits: £80000

Calculation: Accounting Profits+ (Transition Profits-Overlap Profits)

= 55000 + (40000-15000)

= 55000 + (25000)

= 55000 + 25000

= 80000

Here £25000 is the profit available for transition spread.

Now we will navigate to the Self-Assessment Full form in Nomi and enter the data.

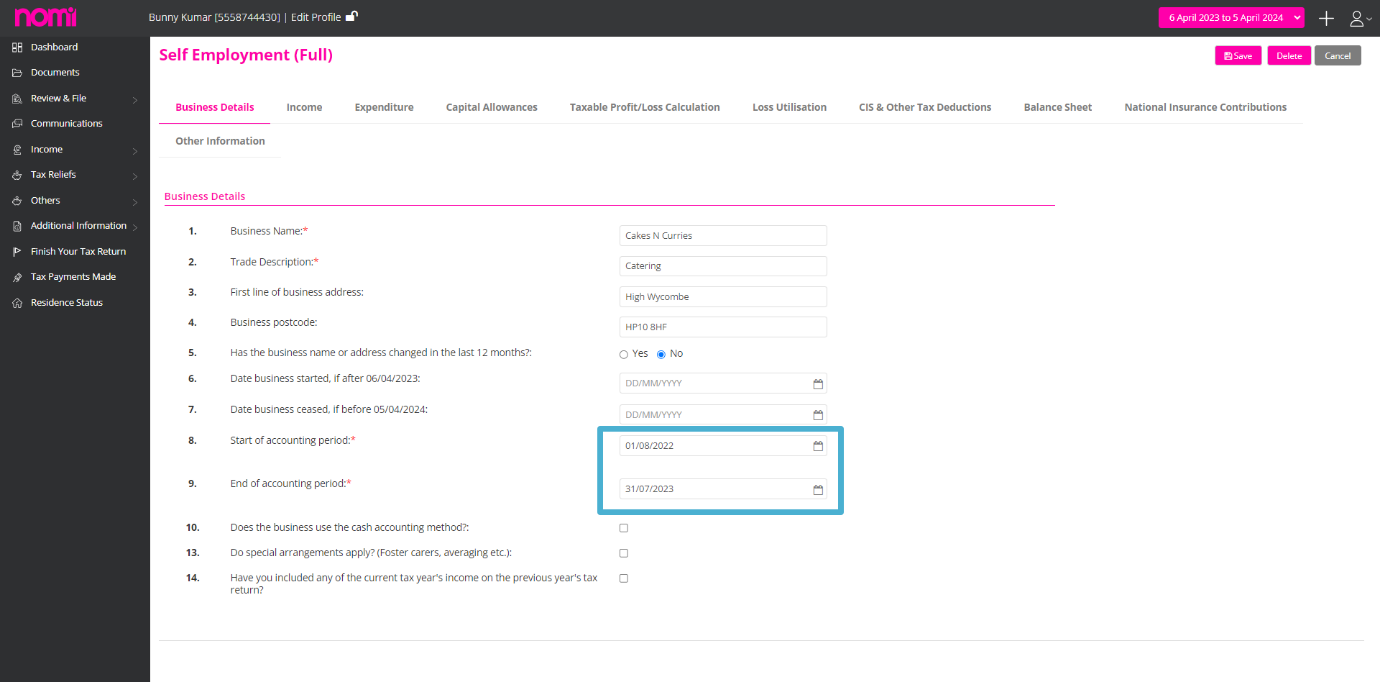

To access the form, you will have to navigate to Agent Hub>>Self-Assessment>>Client List>>Click on Client Name>>Income (left vertical)>>Self Employment>>Click on + New Self Employment Full.

This will redirect you to the Self-Employment full form and then you can enter the data such as Business Name, Trade Description and Accounting Period Start and End Date.

Please note that this Accounting Period should be the one for which you have calculated the Accounting profit.

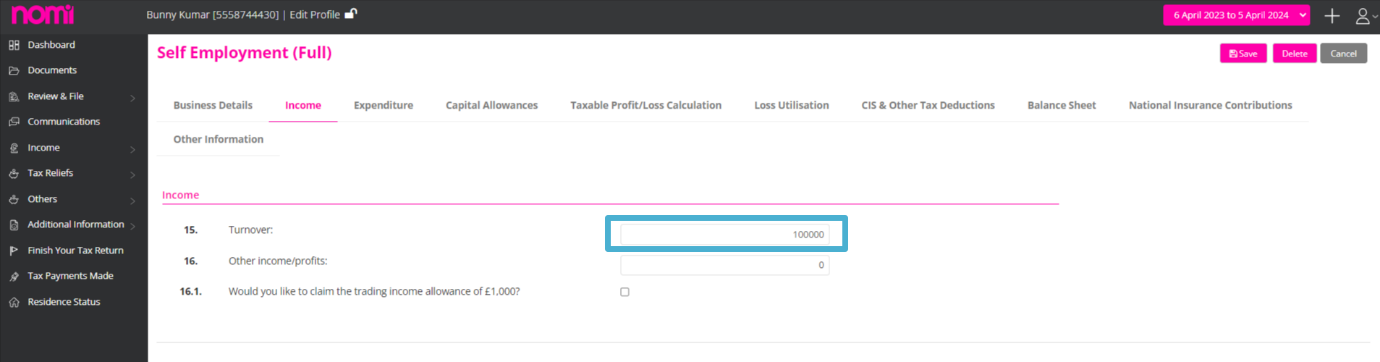

Then you have to enter the Income which includes the turnover or any other profits.

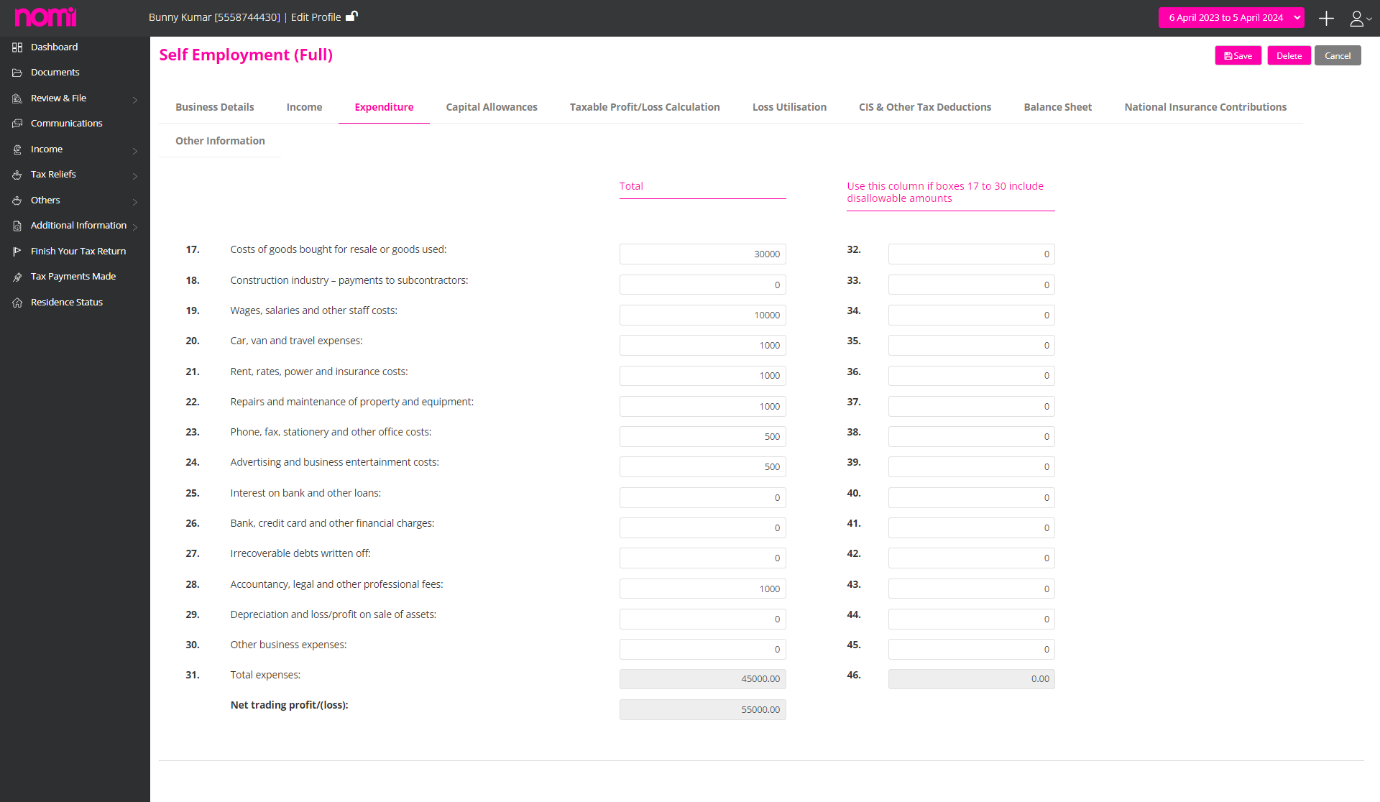

After this kindly record all the Expenses along with any Capital Allowances.

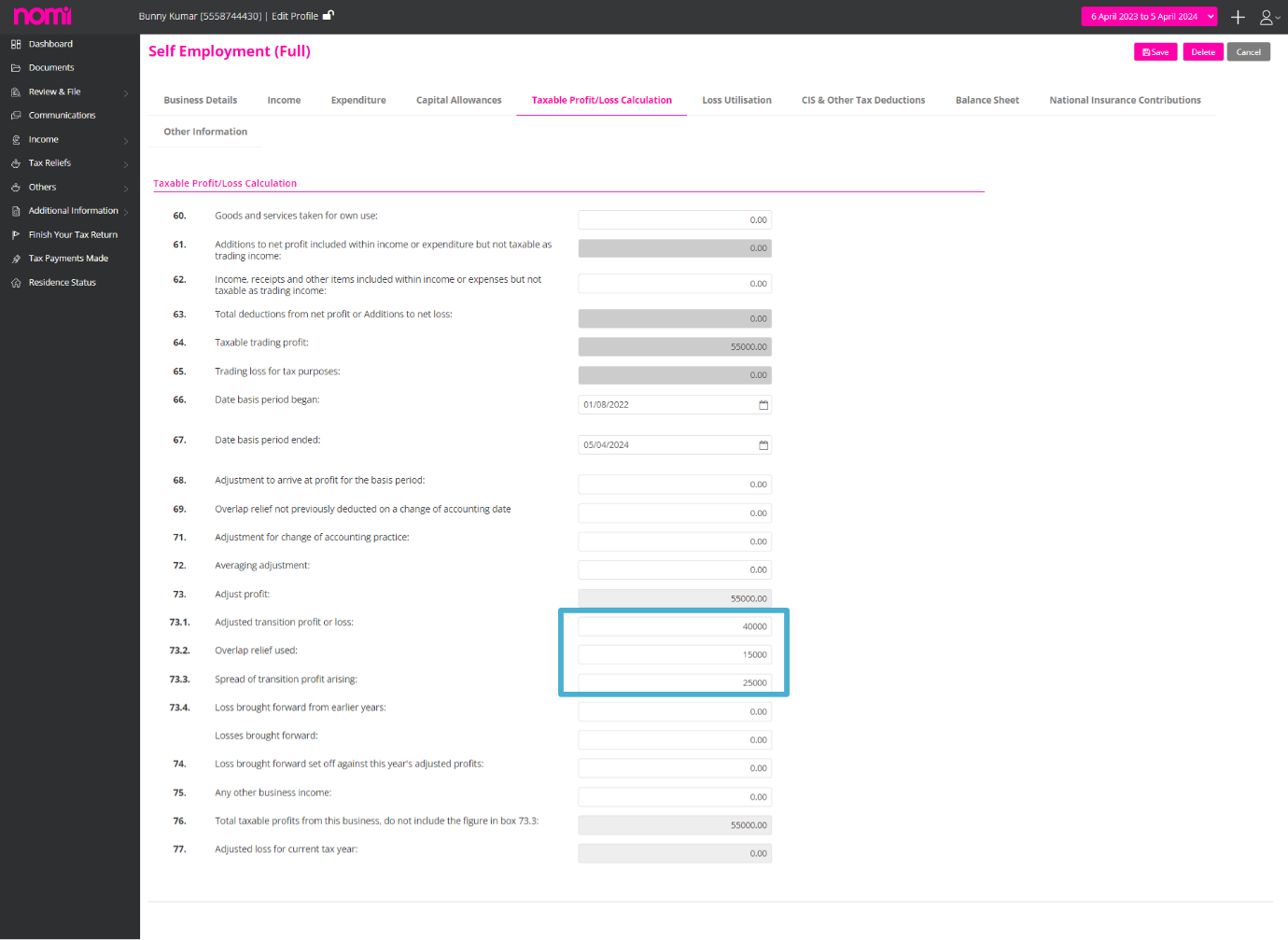

After recording all the Incomes and Expenses you will have to click on Taxable Profit/Loss Calculation. On this screen you will have to enter the Basis period start and end date under Box 66 and Box 67.

Then you can see Box No 73 where the Adjusted Profit value is showing up which is £55000. After this we have, the following boxes and we can enter the data accordingly:

- Box no. 73.1- Adjusted Transition Profit or Loss: As per the test case we can enter the £40000 value in this box.

- Box No. 73.2-Overlap Relief Used: As per the test case we can enter £15000 value in this box.

- Box No. 73.3- Spread of Transition Profit arising: As per the test case £25000 is the transition profit spread.

Box 73.1-Box 73.2= Box 73.3.

Please note that these are manual calculations and not automatic.

How is the Tax calculated?

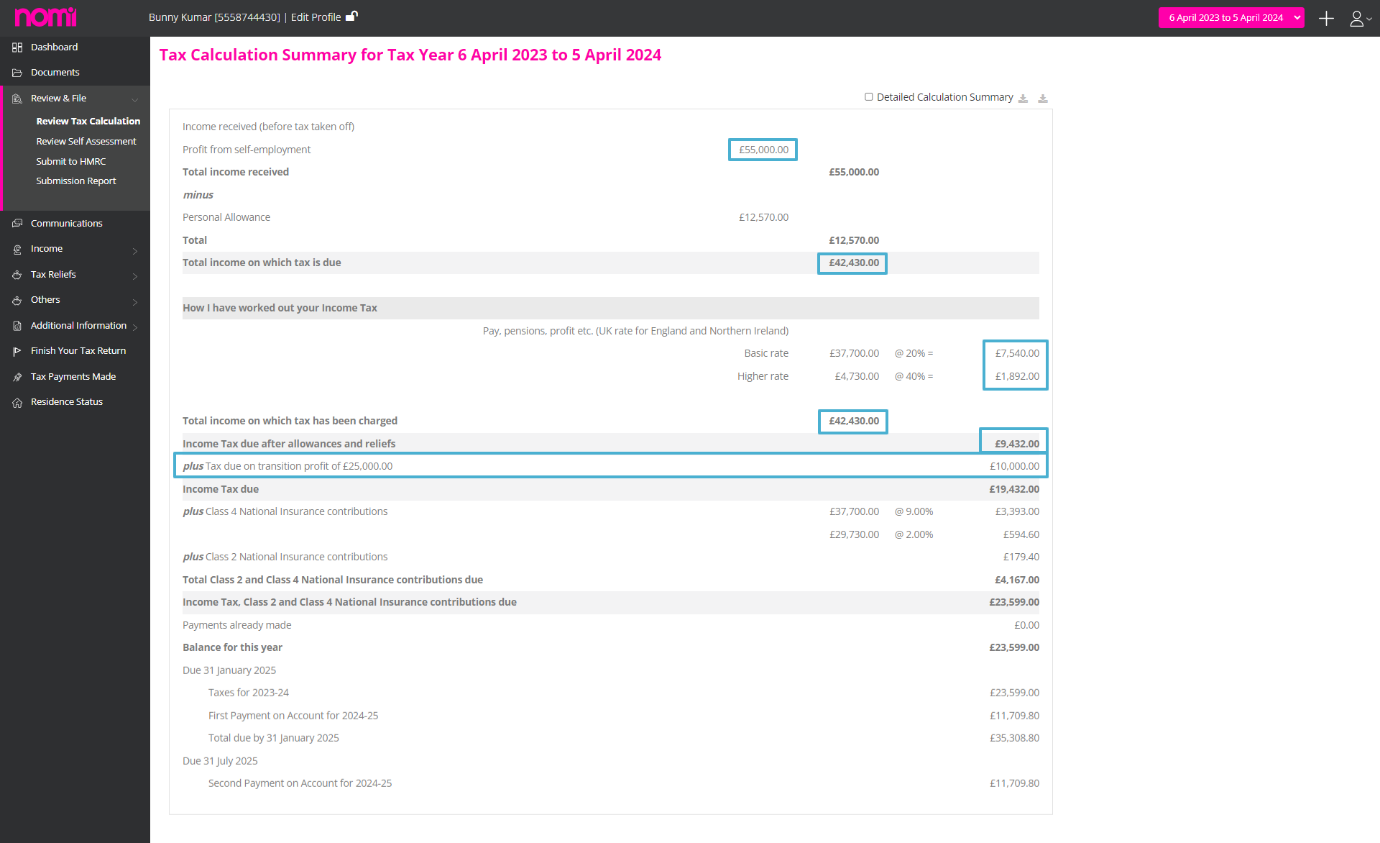

To check the tax implication we have to review the Tax calculation summary. For this we will navigate to Review & File>>Tax Calculation Summary.

As you can see the tax is calculated on Profit from Self-Employment after deducting the Personal Allowance i.e. The Total income on which tax is due.

Then it also shows you a Tax due on transition profit i.e. £10000.

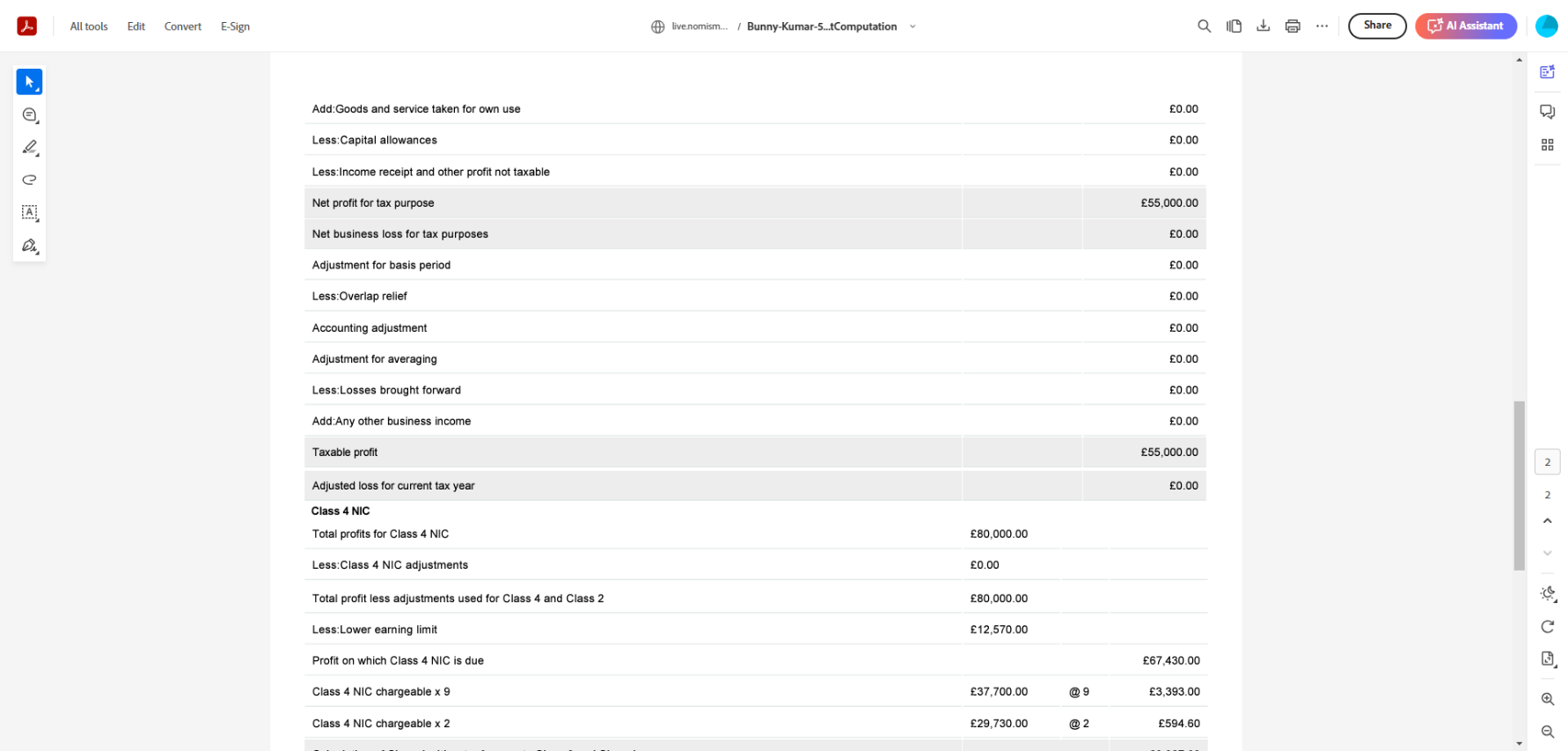

If we see the detailed calculation, then the net profit for tax purposes is £55000, however, for Class 4 NICs the total profits taken into consideration is £80000 which is the total taxable profit.

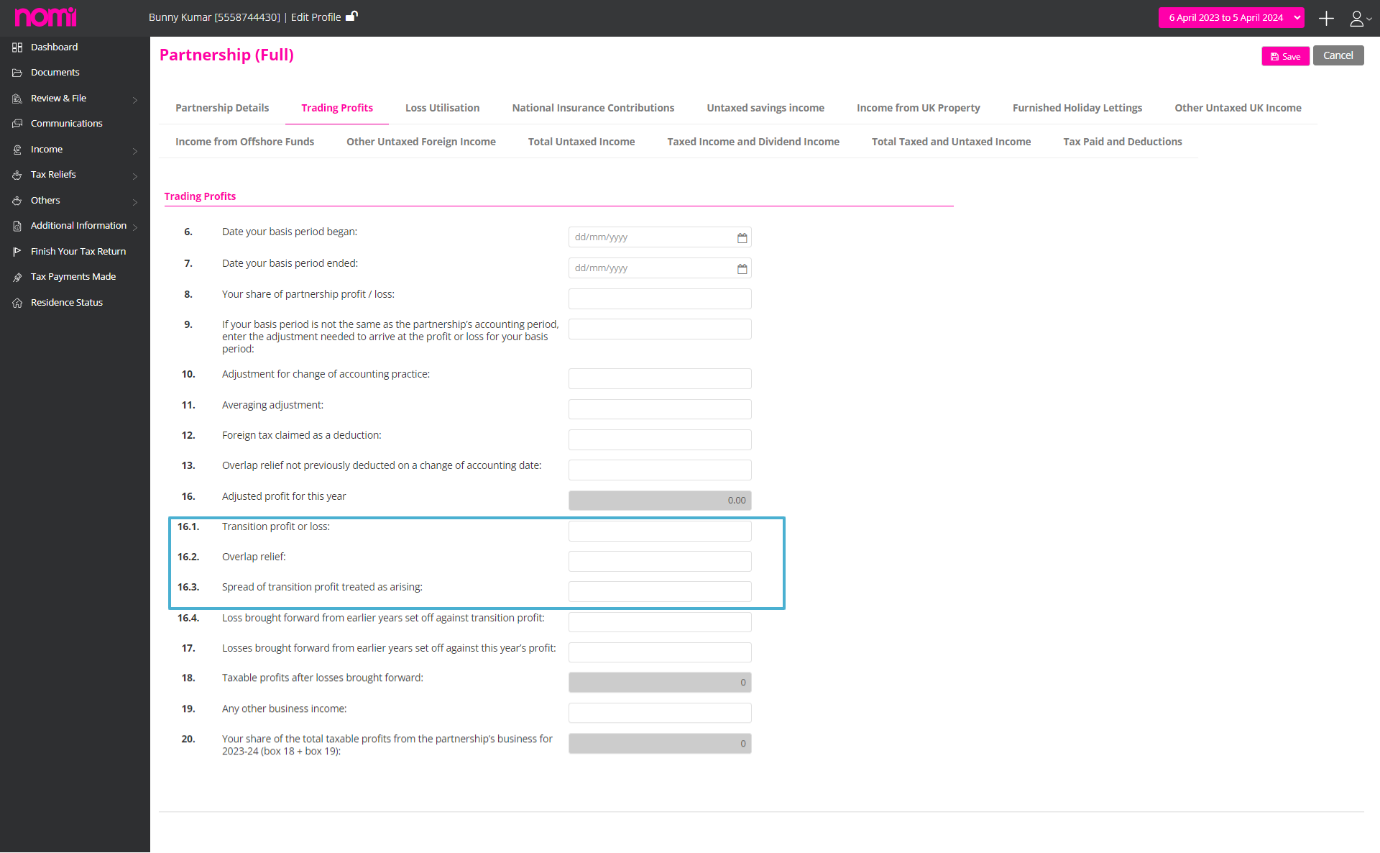

Note: For Partnerships, you will have to enter the values in boxes 16.1 (Transition profit or loss), 16.2 (Overlap relief), and 16.3 (Spread of transition profit treated as arising).

The Basis Period Reform is a positive step towards simplifying tax reporting for businesses. This change aligns your company’s accounting period with the tax year, making financial reporting clearer and more consistent. It’s like syncing your business calendar with the government’s calendar, so everything matches up neatly. This alignment helps reduce confusion and makes it easier to keep track of your finances and taxes.

If you have any questions about how this reform affects your business or need help understanding the changes, don’t worry! We’re here to support you. You can reach out to us anytime by emailing [email protected] or calling our support line. We’re always happy to explain things in a way that makes sense for you and your business.

Want to find out more?

Book a free 30-day trial or talk to one of our advisor and see how our accounting software can help you manage staff, increase profitability and take your practice to the next level.

How to Change a Company’s SIC Code in a Confirmation Statement

As your business grows or evolves, the type of work you do might change too,...

Read More

How Accounting Software Helps with Final Accounts Preparation

As the financial year ends on April 5, it's time to prepare your final accounts....

Read More

Be Audit-Ready: What HMRC Wants to See in Your Corporation Tax Records

Keeping accurate financial records has always been an important part of running a compliant limited...

Read More

Onboarding That Wins Clients: A Smarter Start For Accountants

Client onboarding is about more than just ticking admin boxes. A smooth, professional client onboarding...

Read More